income tax calculator uk

This calculator gets you a full breakdown of the deductions on your profits with minimum inputs required. You just input your turnover and associated costs select the period for those figures and add any options required.

How To View And Download Your Tax Documents

Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year 6 April 2022 to 5 April 2023.

. You do not get a. Your gross hourly rate will be 2163 if youre working 40 hours per week. UK PAYE Tax Calculator 2022 2023.

Youll then get a breakdown of your total tax liability and take-home pay. Easy to use UK tax returns software Price from 1495 plus VAT. Guide to your salary calculations Gross income - The total salary wage pay before any deductions or taxes.

UK Tax Salary Calculator Calculate your net salary and find out exactly how much tax and national insurance you should pay to HMRC based on your income. Just enter your salary into our UK tax calculator. The total tax you owe as an employee to HMRC is 117413 per our tax calculatorYour employer collects this through PAYE and pays it over to HMRC on your behalf.

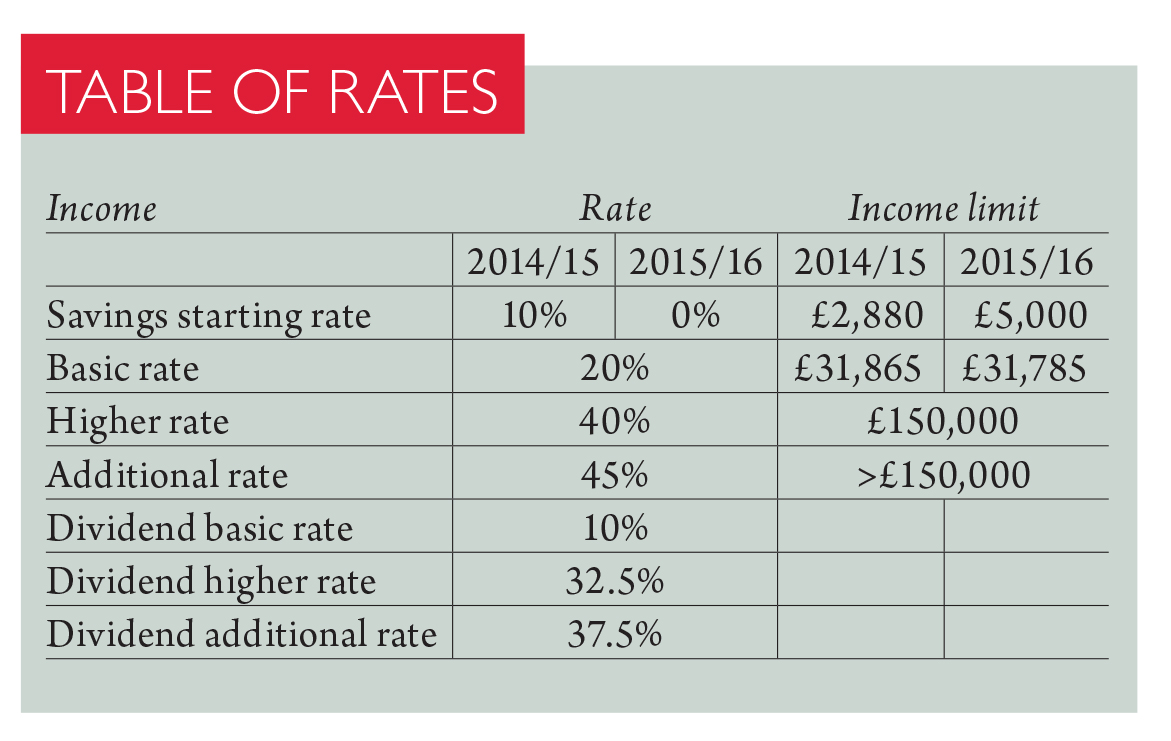

Between 50271 and 150000 youll pay at 40 known as the higher rate and above 150000 youll pay 45 the additional rate. UK Salary Calculator Take-Home Pay in the UK Simply enter your annual or monthly income into the salary calculator above to find out how UK taxes affect your income. The 202021 tax calculator provides a full payroll salary and tax calculations for the 202021 tax year including employers NIC payments P60 analysis Salary Sacrifice Pension calculations and more.

Unless you are earning over 125140 then your tax is calculated by simply taking your Personal Allowance amount away from your income. UK income tax calculator shows your take home pay and PAYE owed to HMRC. Income tax for United Kingdom is tax paid based on your income during the tax year which starts on April 6th and ends on April 5th in the following year in UK.

Use this simple calculator to quickly calculate the tax and other deductions that are taken from income from self employment. Dividend tax calculator Quickly calculate the tax you need to pay on dividends you received from investments. Also known as Gross Income.

If you specify you are earning 2000 per mth the calculator will provide a breakdown of earnings based on a full years salary of 24000 or 2000 x 12. On income between 12571 and 50270 youll pay income tax at 20 - known as the basic rate. Note that your personal allowance decreases by 1 for every 2 you earn over 100000.

Salary Before Tax your total earnings before any taxes have been deducted. Guide to getting paid Our salary calculator indicates that on a 266808 salary gross income of 266808 per year you receive take home pay of 149395 a net wage of 149395. If you are earning a bonus payment one month enter the value of the bonus into the bonus box for a side-by-side comparison of a normal month and a bonus month.

Try out the take-home calculator choose the 202223 tax year and see how it affects your take-home pay. Salary after tax calculator Quickly calculate your take home pay and know how much you pay in taxes. Completed overhauled for 2019-19 tax year our new salary and tax calculator is built to support all your salary and payroll audit needs.

Welcome to the Salary Calculator - UK. Based on a 40 hours work-week your hourly rate will be 1923 with your 40000 salary. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay.

This tells you your take-home pay if you do not have. Find out the benefit of that overtime. The Salary Calculator has been updated with the latest tax rates which take effect from April 2022.

Student loan pension contributions bonuses company car dividends Scottish tax and many more advanced features available in our tax calculator below. Calculator - UK Salary Tax Calculator 40000 Salary Take Home Pay If you earn 40000 a year then after your taxes and national insurance you will take home 30840 a year or 2570 per month as a net salary. Please see the table below for.

The reedcouk Tax Calculator calculates how much Income Tax also known as PAYE and National Insurance NI will be taken from your salary per week per month and per year. Once your Personal Allowance has been taken away the remaining amount will be taxed and your Personal Allowance will be left tax free. Calculator Options Tax year Country.

To use the tax calculator enter your annual salary or the one you would like in the salary box above. 20000 after tax breaks down into 1415 monthly 33000 weekly 6600 daily 963 hourly net salary if youre working hours per week. All calculations will be based on an full years income at the rate specified.

Our UK tax calculator checks the tax you pay your net wage. If you have several debts in lots of different places credit cards car loans overdrafts etc you might be. UK Income tax calculator Quickly calculate how much tax you need to pay on your income.

UK Income Tax Salary Calculator The calculator below will estimate your net take home pay. Further information on the inputs and outputs can be found below. United Kingdom UK Income Tax Calculator.

Youll pay 6500 in tax 4260 in National Insurance and your yearly take-home will be 34240. Chart Display The chart below will update displaying a breakdown of your yearly take home pay tax and NICs paid pension contributions and student loan payments. The UK Salary Calculator determines your AnnualMonthlyHourly Take-Home Pay by estimating your Income Tax National Insurance Student Loan and Pension.

Enter your salary below to view tax deductions and take home pay and figure out exactly how much money youre left with at the end of the month. How Is Tax Calculated. Updated for April 2022.

Gross Income Per Year Month Week Day. Ad UK personal tax returns calculation software Price from 1495 plus VAT. Select the time for which you are paid.

See where that hard-earned money goes - with UK income tax National Insurance student loan and pension deductions. You can also see the rates and bands without the Personal Allowance. If your salary is 45000 a year youll take home 2853 every month.

More information about the calculations performed is available on the about page. Income Tax Calculator is quick and easy to use.

How To Calculate Income Tax In Excel

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Uk Tax Calculator Cheap Sale 51 Off Www Simbolics Cat

How To Calculate Income Tax In Excel

Income Tax Calculator For Fy 2022 23 Old Vs New Eztax

Income Tax Calculator Uk Deals 53 Off Www Simbolics Cat

70 000 After Tax 2021 Income Tax Uk

Income Tax Calculator Uk Deals 53 Off Www Simbolics Cat

Income Tax Co Uk Uk Tax Calculator Home Facebook

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

After Tax Calculator Sale 55 Off Www Simbolics Cat

Income Tax Calculator Uk Deals 53 Off Www Simbolics Cat

Income Tax Co Uk Uk Tax Calculator Home Facebook

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

3 500 A Month After Tax Us May 2022 Incomeaftertax Com

Uk Tax Calc Cheap Sale 50 Off Edetaria Com